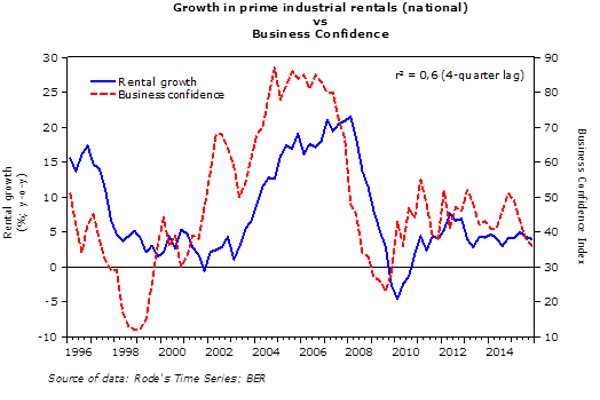

The corresponding graph shows the robust correlation between the growth in prime industrial rentals (nationally) and changes in business confidence (the latter ex BER). Naturally, business decision-makers can be expected to be hesitant to expand production capacity by renting more space when they are dissatisfied with prevailing business conditions.

The confidence index has since 2010 been oscillating around the 45 (out of a 100) mark, but the latest reading for the fourth quarter of 2015 (at 36) shows the first signs of breaking through this rut to the downside. This is the lowest reading in almost six years. Of course, uncertain economic conditions in SA and in the rest of the world, and rising interest rates, are the probable causes of the weak confidence.

Interesting from the graph is the lag of about one year between changes in business confidence and industrial-rental growth. This, naturally, implies that the current low and waning business sentiment levels could result in more downward pressure on industrial rental growth over the next year or so.

In the fourth quarter of 2015, prime industrial rentals could — on a national basis — again only muster growth of about 4%. A look at some of the country’s top industrial conurbations shows fairly impressive growth in industrial market rentals on the East Rand (+7%). This was in contrast to the Central Witwatersrand and the Cape Peninsula, where market rentals grew by a modest 4%. In Durban (-1%), market rentals were slightly lower than what they were a year ago.

In the meantime, work has again started to dry up for non-residential building contractors, forcing them to trim profit margins. Thus, our early estimate is that building costs — overall tender prices — have shown yearly growth of only 2% in the fourth quarter of 2015.

This implies that in all of the major industrial conurbations — barring Durban — rentals were able to show real growth. This means that in a rather depressing environment, the viability of new industrial buildings did not deteriorate during the review quarter.